One year after hiring its first president to grow Applebee’s and IHOP overseas, parent company DineEquity Inc. is poised to accelerate global expansion.

Daniel Del Olmo, president of international for Glendale, Calif.-based DineEquity, said the company has spent the past year building a five-year strategic plan for international growth, as well as bolstering infrastructure in targeted regions.

“In absolute terms, over the course of the next 20 years, international will be leading the agenda simply because there are only 225 restaurants overseas today,” Del Olmo said. “For international, last year was a record-breaking year, with 25 open, and in 2015 internationally, we believe we will exceed our pace with more openings than last year.”

Last year was one of record openings outside the U.S., with 25 new international locations — 18 IHOP units and seven Applebee’s locations — bringing the total unit count for international locations to 225.

Six new franchise agreements were signed during the year, representing about 30 new restaurants.

IHOP and Applebee’s also entered new markets in 2014, including Guam, Indonesia and Singapore, Del Olmo said.

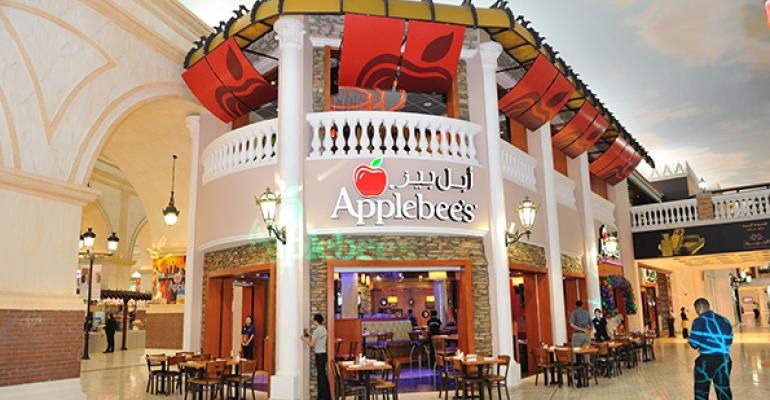

Later this year, DineEquity is expected to unveil new prototype designs for international restaurants that leverage some of its rebranding efforts in the U.S., but will further tailor the brands’ positioning for each market.

With more than 3,600 domestic locations, Applebee’s and IHOP will reach a point of maturity within the next 10 years, at least within the casual-dining and family-dining segments, Del Olmo said.

In October, DineEquity CEO Julia Stewart said the company is also considering an investment in a third brand, preferably an emerging concept that wouldn’t compete with Applebee’s or IHOP, and one with both domestic and international growth potential. Observers have speculated that the company will target a fast-casual brand, but Del Olmo declined to comment.

The company is now focusing on the white space ahead for both brands, especially IHOP, which had only 51 international locations when Del Olmo was hired, compared with Applebee’s 150 overseas restaurants.

IHOP has no clear family-dining competitor outside the U.S., Del Olmo said, although Denny’s Corp., which has about 106 international units, is gunning for more international growth.

With Applebee’s, existing franchise partners have seen the company’s rebranding success in the U.S. and are eager to follow suit, he said.

For both brands, DineEquity is targeting growth in three regions: Latin America, the Middle East and Southeast Asia.

The brands have existed in Latin America for two decades, and the region has 118 restaurants. “There are strong emerging economies there that are continuing to add more emerging middle-class consumers that are looking for aspirational experiences,” Del Olmo said.

In the Middle East, the company has “strong partners that are very well capitalized and very eager to do more with us,” he said. Dining is entertainment there, and Applebee’s has an opportunity to tap into “celebration occasions.”

The brands moved into Southeast Asia in 2013, with their first units in the Philippines, which has led to partnerships in Indonesia and Singapore. China may join the portfolio down the road, as well as parts of Europe, Del Olmo said.

Meanwhile, the company is working with its 45 existing franchisees.

Rethinking the footprint

(Continued from page 1)

Last year, DineEquity launched a research initiative asking both franchisees and consumers in overseas markets what the brands could be doing better. The results were used to develop what Del Olmo calls a “360 Brand Evolution” plan.

The first step is innovating with restaurant formats to make them more flexible. That will include a redesign for both brands, not “copying and pasting” what’s been done domestically, but applying what’s relevant and applicable, Del Olmo said.

They’re also rethinking the footprint. International units are typically between 5,000 and 7,000 square feet. The company is looking at a 2,500-square-foot format, opening up more real estate opportunities, he said.

The positioning will also be tailored to specific markets. For instance, Applebee’s in the Middle East won’t have bars because there isn’t really a bar culture in that region, Del Olmo said.

In Asia, the bars will likely be smaller. And in Latin America, the bar will be separate from the restaurant side, and the brand will emphasize family-friendly aspects.

“It’s looking at the experience within the restaurant a little differently,” he said. “The whole notion of being a bar and grill is something we implicitly owned. Now we’re looking at how we can make the grill the hero of the experience.”

Another component of the rebranding will target culinary innovation. DineEquity has invited the culinary team across all international locations to help identify new menu offerings.

What works on menus in the U.S. doesn’t necessarily work in other countries. For instance, Americans love sweet breakfast products at IHOP, but savory products tend to do better internationally, Del Olmo said.

Marketing efforts will tie into that innovation, with the goal of creating more emotional connections with consumers, he said.

Training will also evolve. Though the international system is entirely franchised, Del Olmo said the company will train general managers and other above-restaurant staff to provide more support for running their businesses.

DineEquity is not the only franchisor of mature brands looking for traction overseas. Other brands, including Johnny Rockets, Quiznos and The Cheesecake Factory, have been aggressively building their international presences.

IHOP and Applebee’s have great appeal in foreign markets, in part because they represent the American dream, Del Olmo said.

“The American dream is still one that is very sought after, particularly in emerging markets,” he said.

International consumers, however, were clear that they are not looking for excessive Americana.

“Consumers are telling us that we’re buying the American experience and the American desire, but we don’t necessarily want to walk into a place that’s plastered with Americana everywhere,” he said. “We took that to heart with the new restaurant design. It’s not always necessary to scream out excessively that we’re all things American.”

Contact Lisa Jennings at [email protected].

Follow her on Twitter: @livetodineout